texas travel nurse taxes

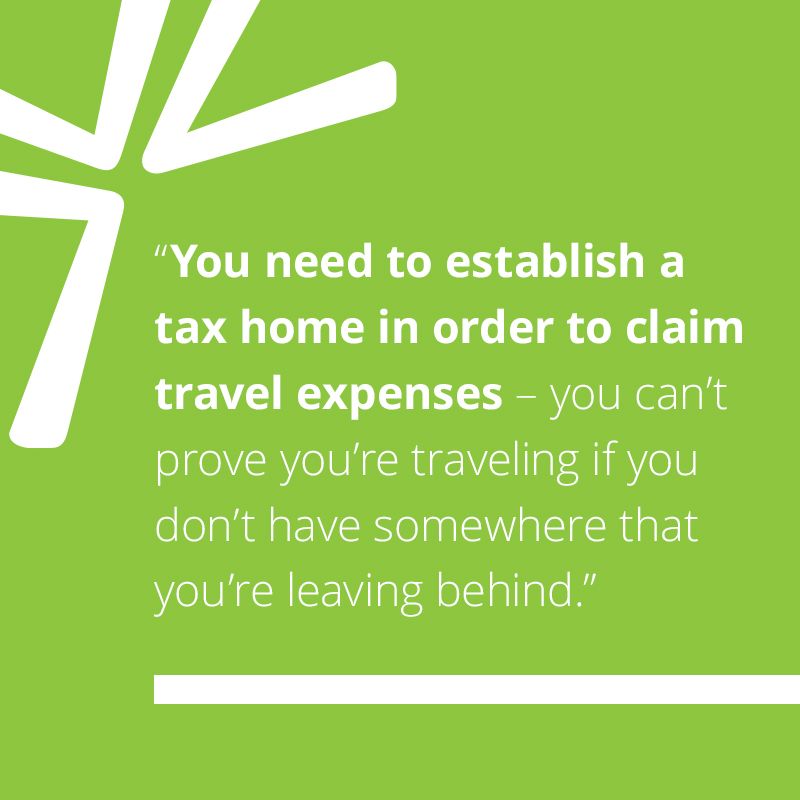

Under the new 2018 tax laws deductions or write-offs are no longer an option for travel nurses. Upload via the Guest Exchange option until given a personal portal account by us after appointment.

How To Become A Travel Nurse Salary Requirements

I dont have a proper Tax house but I had planned to move my appliances and belongings to my sisters apartment in California and help her pay half the rent.

. Flex RN - TX locations Pay Rate. Texas travel nursing has it all. The average salary for a travel nurse in California is 106650.

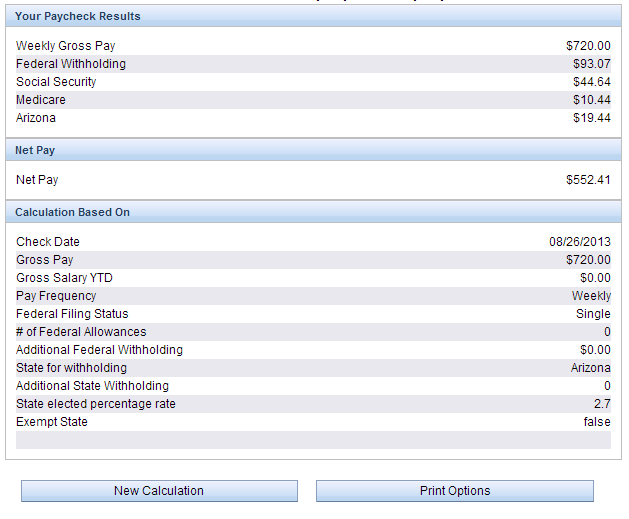

42hr Are you an R N who wants to travel 3 days a week to. Or are paid a fully taxable hourly wage taxed on the total rate of pay. 1 Fill Out Workbook Send Us Your Tax Documents.

For the latest job listings be sure to call your recruiter at 800-884-8788. From the most current travel nurse job listings to available housing The Gypsy Nurse Texas travel nurse page is updated with the lastest listings to help you locate apply and secure your next travel nurse assignment in Texas. I could spend a long time on this but here is the 3-sentence definition.

Keep a notebook of your spending and mileage. A blended rate combines an hourly taxable wage such as 20 an hour with your non-taxable reimbursements and stipends to give you a higher hourly rate. Work with a professional.

Since travel nurses are working away from their tax home certain companies must legally provide stipends andor reimbursements for their work more on this below. Here is an example of a typical pay package. However I was told that since California isnt part of the mu.

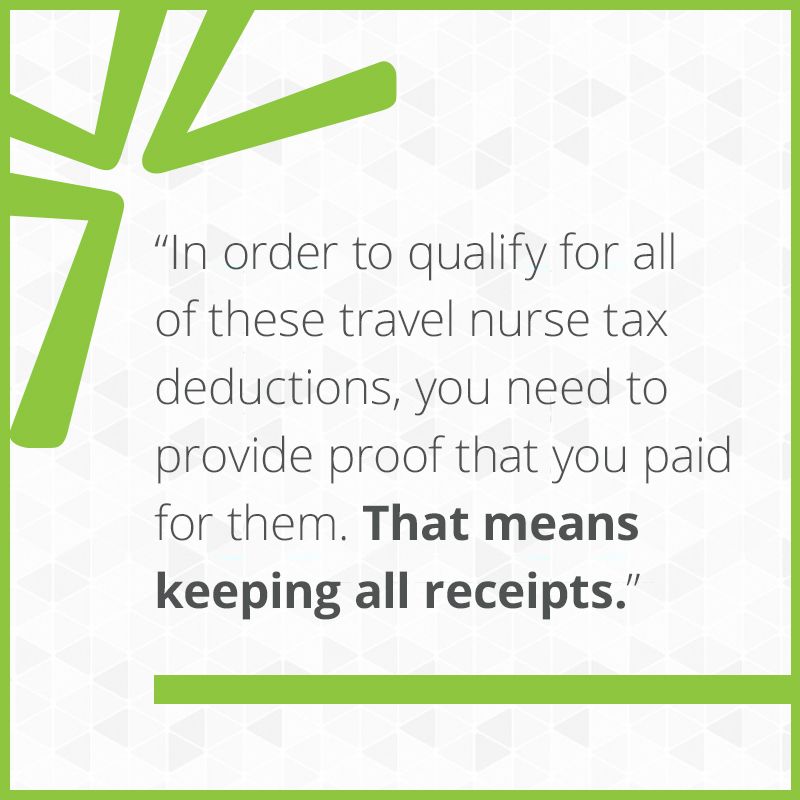

This means travel nurses can no longer deduct travel-related expenses such as food mileage gas and license fees and the only way to recuperate this money is either through a stipend from your travel agency or in the form of reimbursements for expenses you actually. Under the effects of the COVID-19 outbreak the healthcare world is facing unprecedented challenges and the financial landscape is changing quickly. From the most current travel nurse job listings to available housing The Gypsy Nurse Texas travel nurse page is updated with the lastest listings to help you locate apply and secure your next travel nurse assignment in Texas.

This is the most common Tax Questions of Travel Nurses we receive all year. Tax-Free Stipends for Housing Meals Incidentals. And though doing your taxes may seem less urgent in this landscape COVID-19 will impact your taxes too.

Nursing explains that every state has different laws for filing taxes but travel nurses must file a non-resident tax return in every state they have worked in as well as the state thats your permanent tax home. FEDERAL AND STATE TAX. These specialists can help you figure out your expenses and deductions and ensure that you are following all laws and regulations.

The Texas Board of Nursing will continue normal operations as the State of Texas deals with the COVID-19 outbreak. You may send your workbook travel contracts drivers license voided check tax documents to us via. 2020 TAX GUIDE FOR TRAVEL NURSES 2 2020 is a year like weve never seen before.

I am a travel nurse with a home tax location of Oklahoma. 20 per hour taxable base rate that is reported to the IRS. However to protect our staff from exposure to the virus the Board of Nursing will no longer allow visitors to the agency offices.

How many states have state income tax. I listed yes and it has me complete my Adjusted Gross Income and Tax Paid for that state. We offer many jobs that are not posted online.

If I am a resident of any of these states or the USVI I am not exempt from paying state taxes in the states that I work. 5 Tax Tips for Travel Nurses. When I am filing for my state return it asks if I was taxed on income from another state.

Travel nurse tax deductions include living expenses such as housing stipends housing reimbursements and meals. While higher earning potential in addition to tax advantages are a no. The following states and jurisdictions do not have an income tax.

Texas is a vibrant community with great public facilities and excellent travel nurse job opportunities. Alaska Washington Wyoming Nevada South Dakota Tennessee Texas Florida New Hampshire USVI and the District of Columbia for nonresidents. Texas is a vibrant community with great public facilities and excellent travel nurse job opportunities.

At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike. Client Portal During tax season documents are processed within 24 to 72 business hours. 41 states have income tax.

It is common practice for states that charge income tax to tax travel nurses even though they might not be permanent residents of that state. Not just at tax time. Presently Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming wont tax your travel nurse salary.

Travel expenses such as mileage parking and gas. FREE REVIEW OF PREVIOUSLY FILED TAX RETURNS. Travel nurses are paid a blended rate of tax-free stipends and taxable hourly wage.

It is also the most important since the determination of whether per diems stipends allowances or subsidies are taxable. Indicates Crisis Response position. How much money do travel nurses make in California.

I worked a contract in South Carolina last year. Having a professional help you with filing your taxes is always a smart decision. 250 per week for meals and incidentals non-taxable.

This is especially true for those of you who are new to travel nursing. The only condition to qualify for Tax-Free income is that the traveler must be working in a state that is not their tax home. While working as a travel nurse adds an additional layer of tax challenges it can also be a great way to gain a tax advantage.

Travel Nursing Tax-Free Stipends and Permanent Tax Homes There are two ways you can be paid as a travel nurse. Travel RNs may be able to deduct certain nontaxable items from their annual tax filing. NLC indicates a Compact State.

I am a Florida RN who is planning to start travel nursing on May 2020. 1 A tax home is your main area not state of work. Travel Nurse Tax Deduction 1.

FREE YEARLY TAX ORGANIZER WORKSHEET. Is aware of emergency procedures in the event of emergency. From music and the arts to sports rodeos wide-open plains and lively cities like Dallas Houston and San Antonio.

The most prominent Travel Nurse Tax Deductions are Tax-Free Stipends for Housing Meals Incidentals Travel Reimbursements and Professional Development Costs.

Tax Deductions For Nurses Rn Lpn Np More Everlance

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

How Much Do Travel Nurses Make Factors That Stack On The Cash

How Do Taxes Work For A 1099 Travel Nurse Clipboard Academy

Travel Nurse Tax Guide Wanderly

Texas Travel Nurse Icu Rn Icu Nursing Icu Rn Travel Nursing

Lpn Travel Nurse Salary Comparably

Trusted Guide To Travel Nurse Taxes Trusted Health

Top Tax Tips For Nurses Ameritech College Of Healthcare

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

4 Must Know Rules To Tax Free Money As A Travel Nurse Nomadicare

How To Calculate Travel Nursing Net Pay Bluepipes Blog

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Learn All You Need To Know About Working As A Travel Nurse In The United States With This Infograp Nursing Programs Accelerated Nursing Programs Travel Nursing

Benefits Of Agency Placed Housing Travel Nurse Housing Tips In 2022 Travel Nursing Travel Nurse Housing Nursing Tips

Travel Nursing Tax Questions Answers In 2022 Travel Nursing Nursing Tips Nurse

What Is An Average Housing Stipend For A Travel Nurse Trusted Nurse Staffing

4 Must Know Rules To Tax Free Money As A Travel Nurse Nomadicare

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing